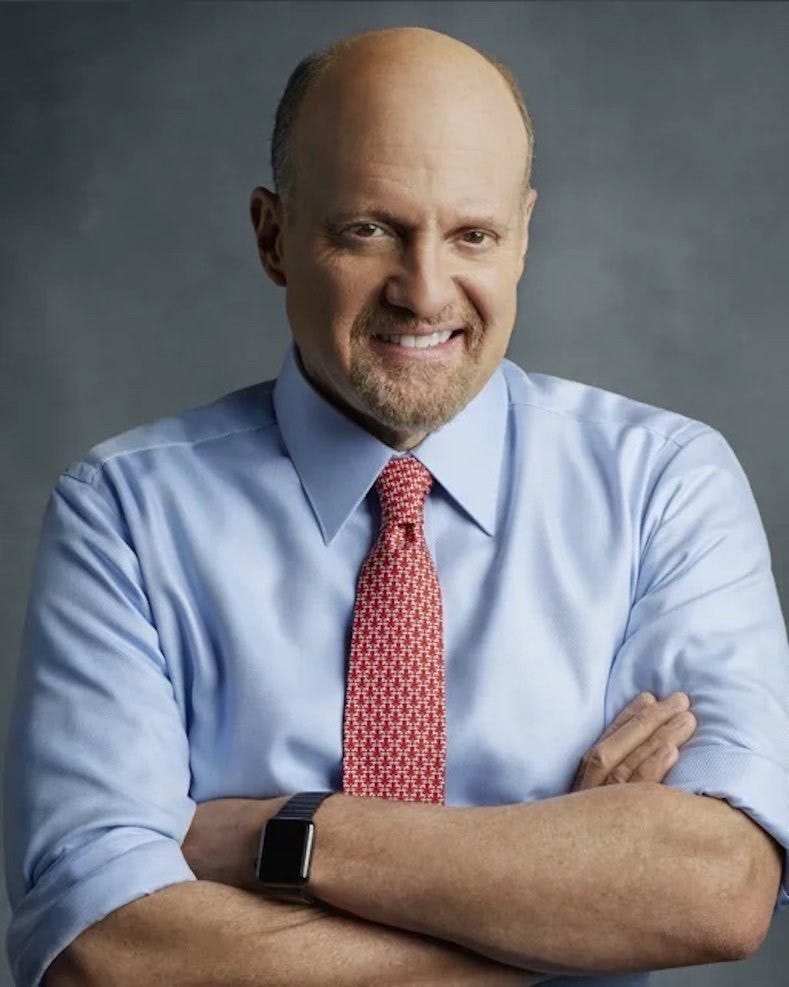

How Chris Josephs and the Inverse Cramer Strategy Exposed the CNBC Stock Guru’s Track Record

Betting against CNBC’s most bombastic stock picker.

Jim Cramer has spent decades shouting stock picks at America, but in the age of social media and data-driven investing, one thing has become painfully clear—he might just be the best contrarian indicator in finance. Enter Chris Josephs, co-founder of Autopilot, a financial app that helps investors track politicians and media personalities’ trades. Josephs didn’t just joke about Cramer’s stock-picking prowess; he quantified it—and turned it into a wildly successful Inverse Cramerstrategy.

Who Is Chris Josephs, and How Did He Expose Jim Cramer?

Chris Josephs isn’t just another finance bro making memes about Cramer’s latest bad stock call—he built a data-backed strategy that exposed just how bad some of those calls actually were.

Through Autopilot, Josephs created a portfolio designed to do the exact opposite of what Jim Cramer recommends:

If Cramer says buy, Josephs’ system shorts the stock.

If Cramer says sell, the system goes long.

The results? A 48% return in 2024.

That’s right—doing the opposite of Jim Cramer has been more profitable than actually following his advice. The strategy has turned into a full-fledged financial movement, leading to the creation of Twitter accounts like @CramerTracker, dedicated to exposing the CNBC host’s questionable stock predictions.

The Rise and Fall of the Inverse Cramer ETF

Josephs wasn’t the first to capitalize on the Cramer effect. In March 2023, Tuttle Capital launched the Inverse Cramer ETF (SJIM), a fund designed to systematically bet against Cramer’s stock calls. The ETF gained widespread media attention, but retail investors didn’t bite.

Despite the meme potential, SJIM only attracted $2.4 million in assets and ultimately shut down in early 2024 after posting a 15% loss.

However, Josephs’ data-driven approach has kept the movement alive. Unlike the ETF, which struggled with execution, Autopilot’s algorithmic trading model is proving that fading Cramer is still a profitable venture.

Why Is Jim Cramer So… Wrong?

So why does the Inverse Cramer strategy work so well? Here are a few theories:

1. Retail Investors Are the Last to Know

Cramer’s audience consists mostly of casual retail investors, who often act on news after the market has already priced it in. By the time Cramer is telling his audience to “BUY BUY BUY,” hedge funds and institutional traders have already made their moves—meaning retail is often buying at the top.

2. Overconfidence Bias

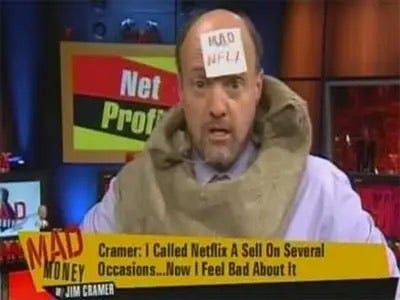

Cramer speaks with extreme confidence, even when he’s dead wrong. His infamous Bear Stearns call in 2008—when he declared “They are fine!” just days before the bank collapsed—is proof that conviction does not equal accuracy.

3. Media-Driven Hype

Cramer is notorious for pumping stocks that are already in the news cycle. By the time he makes a bold call on a tech company or a meme stock, the big money has already rotated out. Josephs’ model exploits this delayed reaction.

What’s Next for the Inverse Cramer Movement?

With the SJIM ETF dead, does that mean the Inverse Cramer era is over? Not at all. If anything, Chris Josephs has taken the concept to the next level with his data-driven Autopilot model.

Here’s what we might see next:

More AI-powered contrarian investing – Josephs has already shown that autopilot trading against Cramer works. The next step? AI-driven funds that track other finance gurus with similarly bad track records.

Expansion to Politician Trades – Josephs’ platform also tracks Nancy Pelosi’s stock trades, giving retail investors insight into what Congress is buying and selling. If Inverse Cramer works, Inverse Congress might be even better.

More Social Media Exposure – Accounts like @CramerTracker and other finance meme pages are keeping this movement alive. As Cramer’s picks continue to underperform, expect more viral moments exposing his misfires.

Final Thoughts: Is Jim Cramer the Ultimate Market Indicator?

Chris Josephs didn’t just expose Jim Cramer—he turned him into a data point. The Inverse Cramer strategy isn’t just a meme; it’s a legitimate investment model that has outperformed the market.

At this point, Cramer isn’t just a media personality—he’s Wall Street’s favorite contrarian signal. And thanks to people like Chris Josephs, investors can finally profit from doing the opposite.